By: Brian Fechter

Across all industries there are a handful of terms that are unanimously deemed to be “buzz words” that are untenable by nature. You may have heard of classics such as: synergy, visibility, or holistic.

In the wealth management space, the unequivocal gold medal winner of buzzwords (or in this case, buzz acronyms) in the past decade is ESG.

Opinions on ESG in the advisory space are as polarizing as political beliefs. Between clients and advisors themselves, there is an extremely bolded line separating one side of the aisle from the other.

Some advisors feel that ESG is a zero sum game, while many clients believe that ESG investing is more important than investing for the sake of maximizing returns.

So, what is ESG investing exactly? According to the CFA Institute, ESG stands for Environmental, Social, and Governance. To dive deeper into each pillar, the CFA institute goes on to break down each of the 3 pillars as it pertains to ESG investing principles:

Environmental: Conservation of the natural world.

- Climate Change

- Carbon Emissions

- Biodiversity

Social: Consideration of people & relationships.

- Human rights

- Labor standards

- Gender and diversity

Governance: Standards for running a company.

- Board composition

- Political contributions

- Executive compensation

ESG investing is the ideology of considering the above factors into your investment selection and management process. It is not purely about cost, risk, and returns to the owner of the assets, but also taking into account the exposure to real world issues tied to the underlying companies within a fund.

The Tsunami of Tomorrow

Raj Sharma, a Merrill Lynch Private Wealth advisor who’s Boston-based practice has over $6B AUM, states, “Advisors who fail to understand and embrace the ESG paradigm risk losing market share and clients.”

Further stating, “Today ESG might be a trend, but tomorrow it will be a tsunami.” He is comparing the notion of ESG today to how the industry viewed financial planning in the 1990s, which is now a cornerstone within the industry.

Recently interviewed by ThinkAdvisor regarding his commentary on ESG, Sharma stated that this is all tied to a generational change from the current clientele to Millennials and Gen Z.

LOGICLY has touched on this topic several times. Understanding the next generation of wealth management clients and what matters to them will be paramount in capitalizing on the transfer of wealth expected to take place over the coming decades.

How can you better prepare yourself for the incoming tsunami? Here are five strategies to explore and integrate within your practice.

5 Ways to Implement ESG Investing In Your Practice

- Understand the current and future magnitude of the ESG investing space.

The Global Impact Investing Network estimates the worldwide impact investing market size of ESG to be $1.164T as of 2023.

Bloomberg predicts that ESG assets may reach $53T by 2025. That would make ESG investing account for 1/3 of global AUM.

In other words, ESG is not a little fish in a big pond. ESG is a teenage great white shark in an ocean where it will soon be one of the main predators in the food chain.

While opinions are conflicted, numbers cannot be disputed. With flows and AUM into ESG assets increasing at a rapid clip, year over year, it is hard to turn a blind eye to this corner of the investment world.

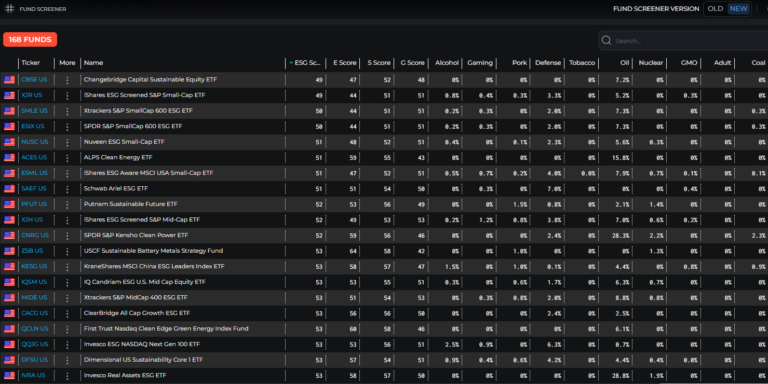

At the moment, there are nearly 200 ESG ETFs trading in the US, but not all ESG funds are made equal.

There are several instances in the market of a fund created to be sustainable and adhere to the framework of ESG, while still having exposure to some of the “warning flags” of controversial industries, such as Oil, Defense, and Tobacco.

LOGICLY’s Fund Screener is a top-tier resource for scanning the ETF and Mutual Fund universe in the United States for ESG funds.

Utilizing our ‘tag’ search for ESG and sustainability, you can then apply our ESG data overlay to see the ESG scores and respective warning flag exposures across US ESG ETFs.

Fund Screener and its entire range of research capabilities are accessible for free in LOGICLY’s Base tier.

2. Speak with the younger generations and hear their opinions on ESG.

By now you may have most likely heard of the mindset gap between the older generations and the up-and-coming Millennials and Gen Z’s from many sources, but seeing for yourself is a surefire way to truly understand how vast the differences are.

Whether you engage in a conversation with your own children, your younger clients, or even the kids of your current clients, you are bound to hear a mix of the same ideologies connected to the core values of ESG investing.

According to a 2018 survey conducted by US Trust, 87% of millennials stated that ESG is important to their investment decisions.

The Stanford Graduate School of Business conducted their own survey in 2022, and found that approximately 2/3 of Millennials and Gen Z’s were very concerned about environmental and social issues like carbon emissions and income inequality.

Many argue that the reasons behind the conflicting sentiments across generations stems from differences in time horizon.

Investors over the age of 50 have a much shorter time horizon until retirement and are not willing to lose out on potential returns and income for the sake of their beliefs.

If they make a move into ESG funds and their portfolios drop in value, they have much less time to recoup those losses and get back on track.

Whereas, investors who are 30 and under have a much longer time horizon. If you have 30 to 40 years until retirement, short term losses and markets swings do not sting nearly as bad.

If you plan to keep your practice running as the generational shift occurs, your understanding of these philosophies is imperative to your survival as an advisor.

3. Learn the differences between SRI, CSR, and ESG investing.

From the surface it may seem that ESG, CSR, and SRI all represent the same framework and views, but there are noticeable differences between the three.

SRI (Socially Responsible Investing) is most closely correlated to the ideals of ESG investing. The difference here is that SRI is a more general term and ideology with a slightly different portfolio strategy.

SRI has historically utilized an exclusionary-based approach to fund selection.

This means that SRI models completely eliminate investments tied to immoral industries, whereas ESG models will exclude some funds with exposure to these immoral sectors, while also including those that are seen as delivering a positive impact within that industry or sector.

CSR (Corporate Social Responsibility) is equally comparable to ESG as SRI is, but in a different way.

Whereas, SRI is more or less adhering to the same guidelines across the spectrum as ESG investing, CSR is essentially a business-based practice that is very similar to the Governance pillar of ESG investing.

Businesses looking to improve the communities they are located in or potentially do their part to protect the environment would implement a CSR plan.

This is a strategy to improve the general public sentiment on a firm and do their part to not take more from the world than they are giving to it.

Of course, a business looking to put a CSR plan in place would take many ESG factors into consideration scaled down to their respective industry and firm.

4. Analyze existing funds in your models for ESG talking points with clients.

You do not have to reinvent the wheel or completely overhaul your fund selection process to be in the know with ESG.

Rather than looking for ESG funds to implement into your models, you can do a deep dive of exposures for current holdings within client portfolios to demonstrate how little or how much exposure they currently have to warning flags in the ESG space.

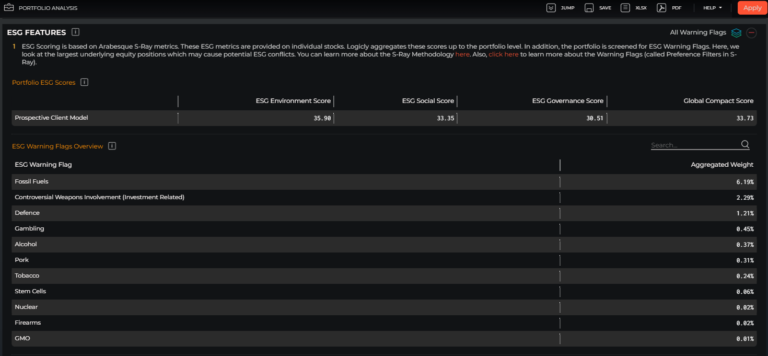

LOGICLY’s Portfolio Analysis handles the dirty work for you with our ESG Analysis output.

Our system dives into the individual stock level exposure across a portfolio, aggregates that exposure up to the fund and portfolio level, and then provides you with a multitude of ESG scores across all pillars to show your clients what they are exposed to within their current investments.

This allows you to have a conversation with your clients that lends to your knowledge and understanding of ESG investing.

From there you can learn about each client’s particular views and aversions relative to warning flag industries and strengthen your relationship, in addition to knowing what to look out for as models and funds change in the future.

Some clients may want to move out of certain funds immediately, others may not care as much. Ultimately, taking this step shows that you are doing your job as an advisor to understand and meet the respective needs of each client.

5. Implement a monitoring system across your book of business for ESG.

If you find yourself with a more than a handful of clients who believe strongly in ESG investing, then you may look to implement some firm-level tools in place to watch out for ESG exposure.

While your models may remain the same, the funds within them are constantly rebalancing and reallocating on their own, which leave you with varying allocations and exposures across client portfolios.

Rather than spending time each day to do research on the recent changes and current holdings within your model funds, why not have a monitoring system in place to alert you of important changes and exposures in real time?

That is where LOGICLY’s Portfolio Coach comes into play!

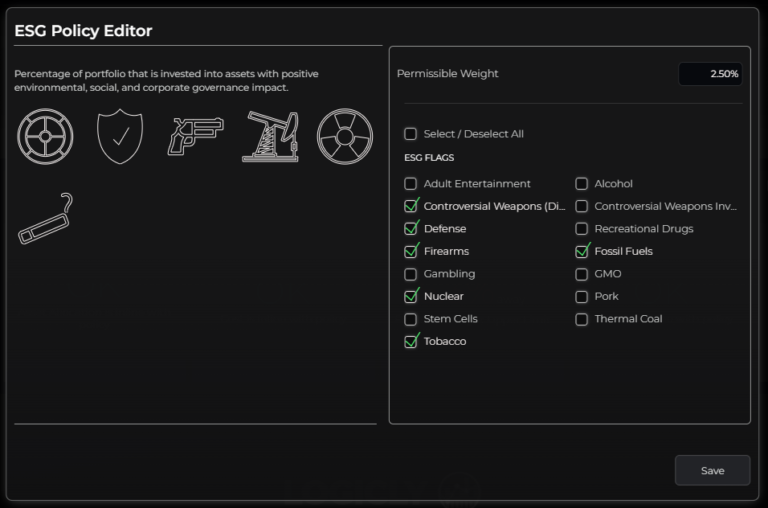

Portfolio Coach is an AI-powered monitoring system that utilizes household-level IPS (Investment Policy Statement) parameters to alert you when a client’s portfolio is deviating from their set targets across 6 criteria, including ESG.

For each household, you have the ability to set a desired permissible weight for ESG exposure across the portfolio(s), while having the ability to select the respective warning flag industries that each client cares about the most.

As time passes and basket exposures across funds change, you will be alerted in real time when a client is approaching the limit of permissible ESG exposure, as well as, when the limit has been passed.

You will then be shown which funds across a portfolio are contributing to being over the limit in addition to seeing the exposures across each of those funds to the ESG flags you have selected for the client.

This way, you will know what conversations to have about which funds with your clients and be able to address the alert via fund replacement or adjustment of permissible weight.

Portfolio Coach is working in the background 24/7 to ensure your book of business is being monitored to meet all guidelines set forth, while giving you time in your day to focus on what matters most: servicing your current clients and growing your firm’s business by bringing in new AUM.

Growing with ESG

As the world becomes more conscious of the environmental and social impact of investment decisions, financial advisors who fail to incorporate ESG considerations into their practice may risk losing relevance in the market.

By embracing the rising trend of sustainable investing, advisors can not only align their clients’ investments with their values but also tap into new and growing investment opportunities that were previously overlooked.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- Cryptocurrency and the Rise of Custodied Assets

- The Future is Here: How Thematics is Disrupting Investing

- ETFs and Volatile Markets

- What Investors Should Do as Year-End Approaches

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Brian Fechter at: brian.fechter@thinklogicly.com