By: Robert Bisewski

In the rapidly evolving landscape of the financial sector, artificial intelligence has emerged as a transformative force, revolutionizing the way investments are managed and analyzed.

As AI-powered algorithms and machine learning techniques continue to advance, they are unlocking new possibilities for investors, enhancing decision-making processes, and reshaping the traditional investment paradigm.

Although artificial intelligence has already made significant strides in the investment realm, it remains in the early stages of its potential impact. This groundbreaking integration of technology promises to redefine the investing world, offering a more dynamic, efficient, and accessible approach to wealth management and growth.

As AI reshapes the investment landscape, the question remains: what is the anticipated impact on the roles and relevance of financial advisors and traditional fund managers?

AI-Portfolios: A Smarter Approach to Investing?

As investors increasingly opt for lower-fee investment products, the concept of an AI portfolio manager is gradually transitioning from a futuristic idea to a potential reality.

At their core, AI portfolios are investment platforms that use algorithms and machine learning to create and manage investment portfolios for clients, with the primary goal of optimizing returns while minimizing risks.

These platforms have gained popularity due to their lower fees, increased accessibility, and personalized investment recommendations.

There are many advantages to AI-Portfolio managers and some examples are as follows:

- Cost-efficiency: AI-driven platforms generally offer lower operating costs due to the automation of various tasks, including research and portfolio rebalancing. This reduction in management fees makes investing more affordable, thereby expanding access to a wider range of individuals.

- Data-driven insights: AI portfolio managers can analyze vast quantities of data, from historical market trends to real-time news, to generate insights that inform investment decisions. This data-driven approach allows for more informed and accurate decision-making, potentially leading to better investment outcomes.

- Personalization: Advanced AI algorithms can create tailored investment strategies based on individual risk tolerance, investment goals, and time horizons. This level of customization allows investors to access personalized portfolios that align with their unique financial objectives.

- Diversification: AI-driven investing platforms can easily identify a wide array of investment opportunities, enabling the creation of well-diversified portfolios. This diversification helps spread risk across various asset classes and sectors, which can contribute to more stable investment returns over time.

- Adaptability and responsiveness: AI systems can quickly adapt to changing market conditions, ensuring that investment portfolios remain optimally positioned to capture opportunities and mitigate risks. This agility allows investors to stay ahead of market fluctuations and potentially capitalize on emerging trends.

Will the future of finance see each investor paired with their own AI advisor, responsible for crafting and managing personalized financial strategies?

Advisors and Fund Managers in the Age of AI

The question of whether ChatGPT and AI portfolio managers can improve investment decisions is an intriguing one. From a portfolio management perspective, these AI-driven technologies undoubtedly offer a wealth of advantages that can enhance decision-making and optimize returns.

However, it’s important to recognize that financial advisors and traditional fund managers still play a crucial role in the investment landscape, and their expertise cannot be fully replaced.

Despite the many strengths of AI Portfolio managers, the human touch of financial advisors and traditional fund managers remains essential. Investors often have unique financial goals, risk tolerances, and personal circumstances that require a deep understanding and empathy that AI systems cannot yet fully replicate.

Financial advisors and fund managers can offer personalized guidance and emotional support, helping investors navigate the complexities of financial planning and decision-making.

Additionally, financial professionals possess expertise in areas where AI may have limitations, such as interpreting nuanced regulations, understanding the intricacies of tax planning, and identifying qualitative factors that influence investment decisions. These skills are vital in providing a comprehensive and well-rounded approach to portfolio management.

However, could we soon see a future where AI systems and traditional fund managers work together effectively, benefiting investors and the financial industry as a whole?

A Symbiotic Relationship Between AI and Advisors

A collaborative relationship between AI-driven systems and human professionals is not only likely to emerge but also holds great promise for the future of the financial industry.

By embracing and integrating AI technology into their practices, financial advisors and traditional fund managers can enhance overall investment performance and provide unparalleled value to their clients.

AI can be used as a powerful tool to complement the expertise of financial professionals in several ways, from powerful analytics to risk management and customized strategies.

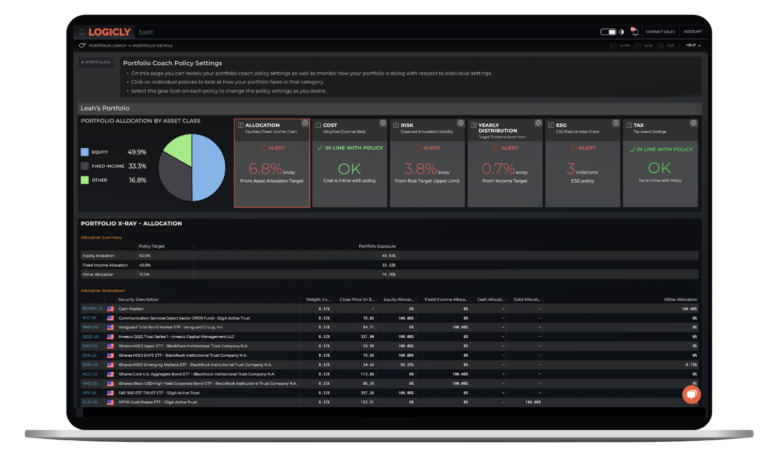

Take LOGICLY’s Portfolio Coach, for instance, an AI-driven tool that streamlines an advisor’s day-to-day workload by maintaining alignment with their client’s investment policy and generating automatic alerts around critical portfolio measurements.

This powerful tool ensures portfolios are optimized through rebalances while taking full advantage of:

- Lower-cost funds

- Tax-alpha opportunities

- Higher-yielding stocks

- ESG metrics, and much more.

The system creates an audit trail on every decision made in a client’s portfolio, pinpointing specific policy suggestions from the Coach, such as risk-reducing, yield-enhancing, and asset allocation rebalancing.

The seamless integration of AI and human expertise provided by Portfolio Coach offers immense potential for financial professionals.

With this solution, financial advisors can save valuable time and focus on higher-value activities, such as building relationships with clients and offering strategic advice.

All in all, with powerful analytics, risk management, customized strategies, efficiency, and ongoing learning, advisors and fund managers can leverage AI technology to optimize investment decision-making, ultimately benefiting investors and the financial industry as a whole.

Enjoy reading this article? Other content you may find interesting:

- How to Navigate the Complexities of Tax Loss Harvesting

- 5 Must Know Strategies for Mastering Tax Season

- Solving the Challenges of Regulatory Compliance for Advisors

- ETFs and Volatile Markets

- 5 Ways to Implement ESG Investing into Your Practice

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Robert Bisewski at: robert.bisewski@thinklogicly.com