By: Brian Fechter

brian.fechter@thinklogicly.com

Not your keys, not your coins…

In the early 2010s, the retail investing ecosystem as we knew it would change in an insurmountable way as we saw the rise of US-based cryptocurrency exchanges offering platforms for Americans to easily purchase Bitcoin.

Not only did these exchanges provide a channel for investors to onramp fiat currency (like USD) into this new market, but many of these exchanges acted as your “wallet” and custodied your coins for you. This is prior to the popularization of digital wallets such as MetaMask (launched in 2016), which allows investors to be in direct ownership of their crypto assets.

The web3 world was a bit like traditional finance in that most assets were held elsewhere, out of the investor’s possession. However, the nuance of custodied assets proved to be an enormous risk in the unregulated world of cryptocurrency, after the infamous Mt. Gox incident.

Mt. Gox is regarded as the first “true” Bitcoin exchange to exist. It was created in mid-2010, sold by the initial creator in March of 2011, and on June 19th, 2011 there was a hack on the exchange, which lead to a security breach and the subsequent theft of thousands of Bitcoins along with Mt. Gox user data.

This spurred the birthing of the mainstream ideology of decentralization and direct ownership of your assets. As the CT (Crypto Twitter) folks say, “Not your keys, not your coins”, referring to the idea that if crypto assets are held out of your possession at an exchange, you do not own them.

With security and safety top of mind in the ecosystem, Coinbase was founded in 2012 and became the model for the centralized exchanges that we see today.

Ease of access to this previously hard-to-reach asset resulted in a snowball effect of newfound demand for cryptocurrency, which in turn opened the “castle gate” for new market participants.

What was initially a valueless asset class, largely unknown to the public, has become a $1 trillion global asset that is estimated to have upwards of 300 million current market participants worldwide.

Retail investors can now access more than 13,000 different cryptocurrency exchanges operating globally, allowing them to add or increase exposure to any of the 10,000-plus tokens in circulation.

Where are the Big Fish?

While the growth and presence of retail investors in the crypto space has been unprecedented, the institutional side of the coin has not had a surge of inflows to match it.

This is not to say that big money is completely absent in the space. Hedge Funds, like the now infamous (and defunct) Three Arrows Capital, have been betting big on the future of finance via cryptocurrency, DeFi (decentralized finance), and NFTs since 2012.

Market participation from players with the liquidity of Hedge Fund and VC backing is great, but what truly moves the markets and facilitates widespread adoption is the entry of institutional assets into an ecosystem.

A great way to draw an analogy to traditional markets is by comparing the AUM of retail exchanges to that of the institutional exchanges. Robinhood, arguably the most popular investment platform for the modern American retail investor, had about $98 billion in AUM at the end of 2021.

Charles Schwab, one of the household names in asset management and custody, has a staggering $7 trillion in AUM.

However, custody assets only tell half of the story. The true institutional impact on market growth lies in the transactional volume that comes from the assets held at an exchange.

In the crypto markets, one of the biggest hurdles to institutional participation is the lack of infrastructure needed for institutions to custody digital assets and execute orders at the size and frequency that is required when dealing with such capital size.

There has yet to be an exchange with the systems in place to support the market activity of billion and trillion dollar institutions. That is, until now.

Enter EDX Markets

On September 13th, EDX Markets, a new crypto exchange, announced that its eyes are fixed on becoming the go-to exchange for institutions supporting the transaction of digital assets.

The idea of capturing the market share and support of institutions is not just a dream for EDX Markets. It’s already starting to come to fruition as EDX has the backing of some of the biggest names in finance: Charles Schwab, Fidelity Digital Assets, and Citadel Securities, just to name a few.

A member of the EDX team said, “The exchange seeks to aggregate liquidity from multiple market makers to reduce spreads, improve transparency, and lower investor costs.”

The exchange is set to launch in early 2023 and usher in a new era of asset management for the whole industry.

Other events that we have seen in recent months hint at the seemingly inevitable collision and merging of worlds between Traditional Markets, Asset Managers and Advisors, and the web3 ecosystem include:

- Fidelity began allowing participants in their 401k plans to allocate some of their retirement savings contributions towards Bitcoin in the first quarter of 2022

- BlackRock announced its partnership with CoinBase to offer access to crypto custody, trading, and reporting capabilities via Aladdin at the beginning of August

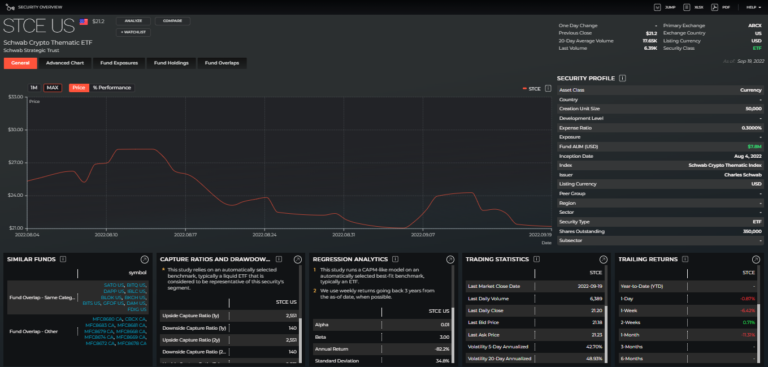

- Charles Schwab announced their Crypto Thematic ETF (Ticker: STCE); launched at the beginning of August

Thinking LOGICLY about Crypto’s Future

Recently, Nasdaq, the second largest US stock exchange, announced that it is seeking approval from the New York Department of Financial Services (NYDFS) to offer cryptocurrency custody services to institutional investors in America.

This further validates the blending and merging of traditional finance and the new class of digital assets in the advisory world.

With all of the systems in place to follow regulations and manage these assets alongside traditional fiat currency, the modern client portfolio will soon be multi-asset, encompassing both web3 wallets and retirement accounts alike.

As more and more portfolios allocate to digital assets, trusted advisors and asset managers will in turn need to allocate more of their efforts towards analyzing and understanding how to navigate advising on this new breed of client funds.

Even amidst a “crypto winter”, the many players in the crypto game have seemingly placed their bets for the market to be just as commonplace to investors and advisors around the world as global stock markets.

With LOGICLY’s recent strategic partnership announcements with Syntax Indices and 401 Financial, we are positioned and ready for the future of wealth management. That way, we can continue to empower and inspire confident outcomes with advisors and clients.

Enjoy reading this article? Other content you may find interesting:

- Getting paid…in Bitcoin?

- The Future is Here: How Thematics is Disrupting Investing

- Beach Bum or Desk Jockey

- Harley Davidson, Sustainability, and ESG

- Women, Millennials, and Financial Planning

- How to Use One of Wall Street’s Best-Kept Secrets

To connect about media inquiries or to discuss the article, please email Brian at: brian.fechter@thinklogicly.com